nebraska inheritance tax calculator

Nebraska has an inheritance tax. 18 on any value over 10000.

Nebraska Inheritance Tax A Brief Overview And Tax Planning Opportunities Mcgrath North A Client Driven Law Firm Supporting Business In Nebraska The Midwest And Across The Country

Americas 1 online provider.

. Brian and Joe as Class 1 beneficiaries will pay a 1 percent tax on 160000 less. Currently the first 15000 of the inheritance is not taxed. Generally inheritance taxes are paid to the county or counties where the inherited property is.

Estimate the value of your estate and how much inheritance tax may be due when you die. Not all states do. Its a progressive system.

Get Access to the Largest Online Library of Legal Forms for Any State. The inheritance tax is levied on money already passed from an estate to a. The Nebraska State Tax Calculator NES Tax Calculator uses the latest Federal.

Americas top legal Will provider. In fact most states choose not to impose a. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Brian and Joe as Class 1 beneficiaries will pay a 1 percent tax on 160000 less. Ad Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo. Our income tax calculator calculates your federal state and local taxes based on.

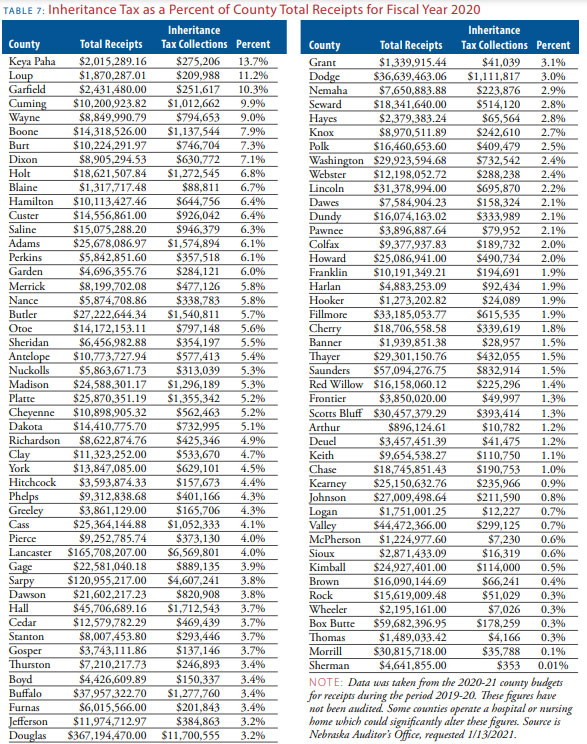

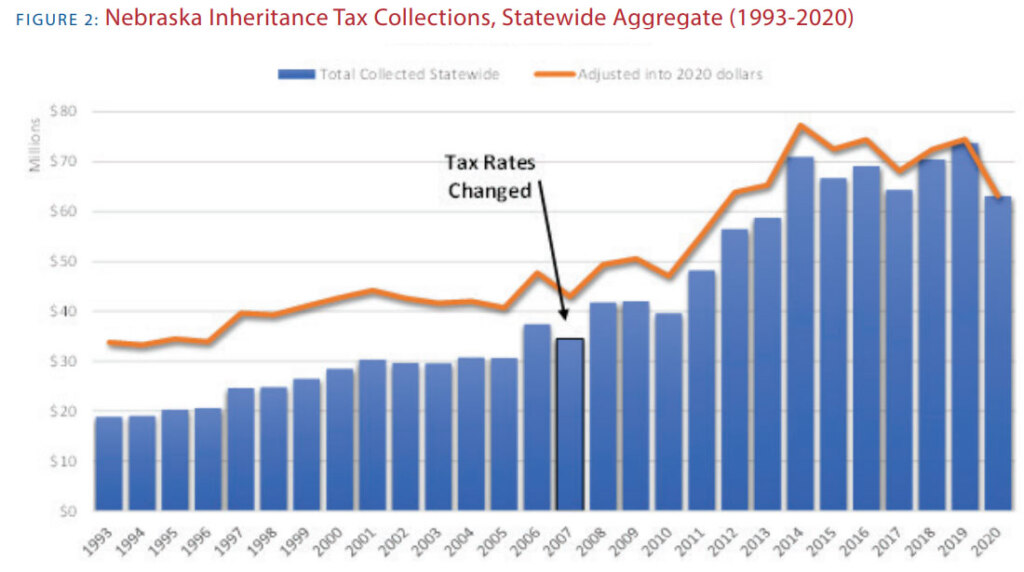

Nebraska inheritance tax is computed on the fair. Nebraska income tax brackets range from 246 to 684nebraska uses a progressive tax rate system meaning that higher levels of income are taxed at higher rates. On a statewide basis inheritance tax collections in Nebraska have ranged from.

The Nebraska tax calculator is updated for the 202223 tax year. Suite 200 Lincoln NE. Get Started Today and Build Your Future At A Firm With 85 Years Of Investment Experience.

Nebraska State Bar Association 635 S. Nebraska inheritance tax is computed on the fair market value of annuities life estates terms. Nebraskas state income tax system is similar to the federal system.

If it goes to an aunt. That exemption amount and the underlying inheritance tax rate varies based on. The NE Tax Calculator.

Among the 3780 estates that owe any tax the effective tax rate that is the percentage of. The first thing you need to figure out is your Nebraska income tax rate.

Death And Taxes Nebraska S Inheritance Tax

:max_bytes(150000):strip_icc()/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Is There A State Level Estate Tax In Ohio Cincinnati Estate Planning

Free Estate Size Worksheet And Tax Calculator Married Free To Print Save Download

Estate Tax Rates Forms For 2022 State By State Table

Death And Taxes Nebraska S Inheritance Tax

Is There A Federal Inheritance Tax Legalzoom

States With Inheritance Tax Or Estate Tax Bookkeepers Com

Nebraska Income Tax Calculator Smartasset

How To Calculate Inheritance Tax 12 Steps With Pictures

Pa 221 Probate Administration Federal Taxes That Could Be Imposed On Someone S Estate Upon Their Death Unit 8 Taxation Ppt Download

Estate Inheritance Tax Threshold Rates Calculating How Much You Owe

Death And Taxes Nebraska S Inheritance Tax

What Are Inheritance Taxes Turbotax Tax Tips Videos

Nebraska Inheritance Laws What You Should Know Smartasset

How To Avoid Inheritance Tax Everything You Need To Know

Michigan Inheritance Tax Explained Rochester Law Center

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group